Your pocketbook, your bank account, even your job and home may be caught up in the sweeping panic, but that doesn’t mean you have to be swept along as well.

In order to survive the fast changing, complex and worrying world of finance, you need to realize that there are sound principles to follow on both the financial side and emotional side that will likely allow you to do much better than those who give in to fear and panic or make rash moves with their retirement accounts.

Here are some tips for navigating the the new financial reality.

On the Finance side:

- Avoid the temptation to time the market

- Pulling money out of your retirement accounts to be safe can wind up costing you big time

- Manage your asset allocations

- Avoid exposure to any one asset class and maintain a balanced portfolio

- If you don’t understand it, don’t invest in it

- You can wind up in big trouble if you don’t know the business or investment vehicle you are investing in

- Live within your means

- Overextended credit can expose you to not only high interest rates, but lock you into an unending cycle of debt

- If you want to engage in active trading – first practice on a demo account

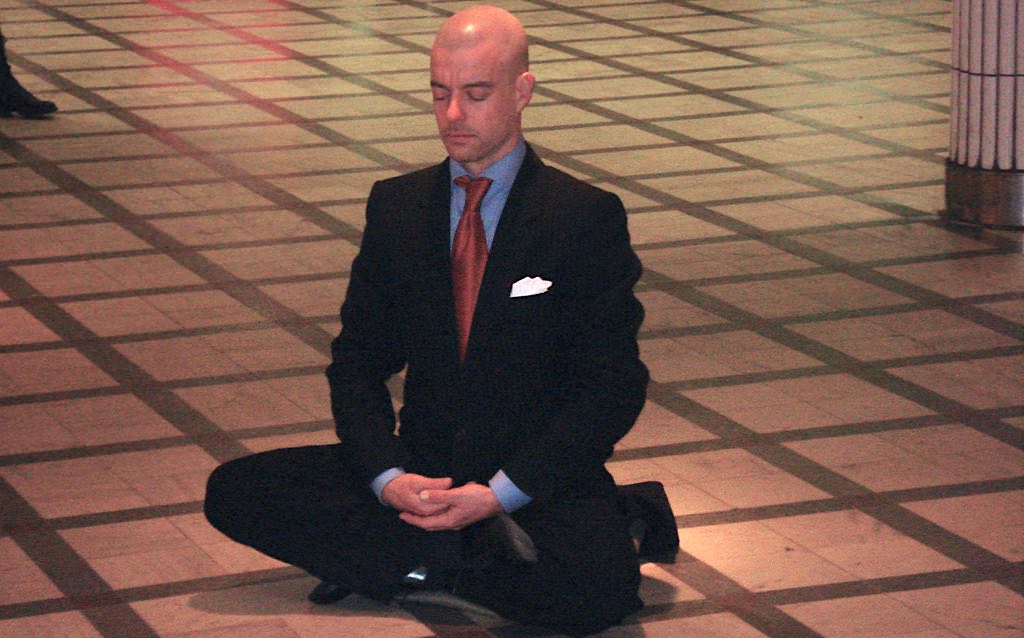

On the Emotional side:

- Be wary of using terms like “crisis,” “meltdown,” “disaster,” etc

- These terms tend to create emotional reactions (energy follows thought)

- Know the difference between who you are and your bank account

- Who you are is not defined by your bank account, house or job

- The universe rewards action, not thought

- You can think about it until the cows come home; results only follow action

- The stability myth

- Life is a process of growth and decay, but never stability – attempts at stability breed instability

Financial Impact: Market Timing Just Doesn’t Work

You have probably heard advice against trying to be a market timer. What is “market timing?” Market timers are people who hope they can sell at the absolute highs and buy at the absolute lows. A financial advisor once suggested to me that for the average individual investor, trading your own account and trying to predict market moves is a bit like putting the average person on the street inside Yankee Stadium and asking them to hit a major league fast ball out of the park. Most would be lucky just to hit the ball at all!

On the practical side, if your 401 (k) has been slammed like just about everyone else’s, about the worst thing you could do would be to panic and withdraw those funds. Why? Most people who are withdrawing their retirement funds are putting them in cash, or other “safe” places, not unlike the mattress. The problem is that you have to sell the underlying securities or mutual funds in order to move to cash. Clearly, those securities and mutual funds are selling at depressed prices right how.

If your plan is to buy back later, when things are better, you certainly will be able to do so. However, let’s say you originally bought into your mutual fund at $100 per unit. It is now down roughly 35%, so you sell for $65, guaranteeing a loss of $35. Now you park it in cash somewhere, maybe earning 3-4%, and you wait for the market to turn.

If your plan is to buy back later, when things are better, you certainly will be able to do so. However, let’s say you originally bought into your mutual fund at $100 per unit. It is now down roughly 35%, so you sell for $65, guaranteeing a loss of $35. Now you park it in cash somewhere, maybe earning 3-4%, and you wait for the market to turn.

By the time you buy back in, you may wind up paying, say, $85 for that same share you sold for $65. So, now you have lost the original $35, and you also missed the $20 upside move. That means you missed out on $55 of value!

Here’s a related scenario: let’s say you are someone who contributes monthly to your 401 (k), adding a little bit each month. You may be tempted to stop contributing, because you want your money to be “safe.”

Why is this a bad idea? Well, if you are contributing each pay period right now, you are buying those mutual funds at “nicely” depressed prices. So what happens when they rebound? Those shares you bought at lower prices move up and become worth more – much more than you are going to make in a 3-4% cash return scenario.

If you can be patient, and follow the second piece of advice which follows, you will probably do much better than those who panic and make rash moves with their retirement accounts.

Emotional Impact: Be Wary of Fear Based Language

The press is full of stories with lead lines about crashes, recessions, depressions, meltdowns, bubbles bursting, and panic. While there is no question that we are going through a period of big swings and those swings are likely to be with us for a while, you don’t have to get caught up in the emotion of it and wind up becoming volatile yourself.

In fact, if you do let your emotions swing with the rise and fall of the markets, you may become part of the problem you are trying so hard to avoid. How is that?

The more you tell yourself that something is scary, the more some part of you listens and starts to produce scary feelings to go along with what you are telling yourself. Last week, I wrote about this with the notion that energy follows thought. The primary problem with negative feelings is that, well, you feel them. Right there in your stomach, or wherever your fear feelings show up.

Once you feel them, they become very real. If you keep reminding yourself that you are in the midst of a meltdown, financial crisis, etc, the feelings may become so strong that you just have to do something. The growing sense of panic may lead to the decision to exit the market, park your money somewhere “safe” and you then wind up becoming victim to your own choices to behave like a market timer. And, even if you are on the sidelines, you may still wind up feeling scared!  And now you have the double whammy of probably missing upside moves as well as still being scared.

And now you have the double whammy of probably missing upside moves as well as still being scared.

You can find out more about Russell Bishop at www.lessonsinthekeyoflife.com.

The author of Lessons in the Key of Life, Russell is an Educational Psychologis, professional life coach and management consultant, based in Santa Barbara California. (A version of this article was originally posted on HuffingtonPost.com)