Cheap, efficient, new and exciting, Montreal’s new automated light rail transit system which recently opened is a major accomplishment for a country routinely criticized for its public transport.

Taras Grescoe is an expert in metropolitan rail systems around the world, and by his estimation, the Réseau Express Métropolitain (REM) should be a case study for the whole of North America.

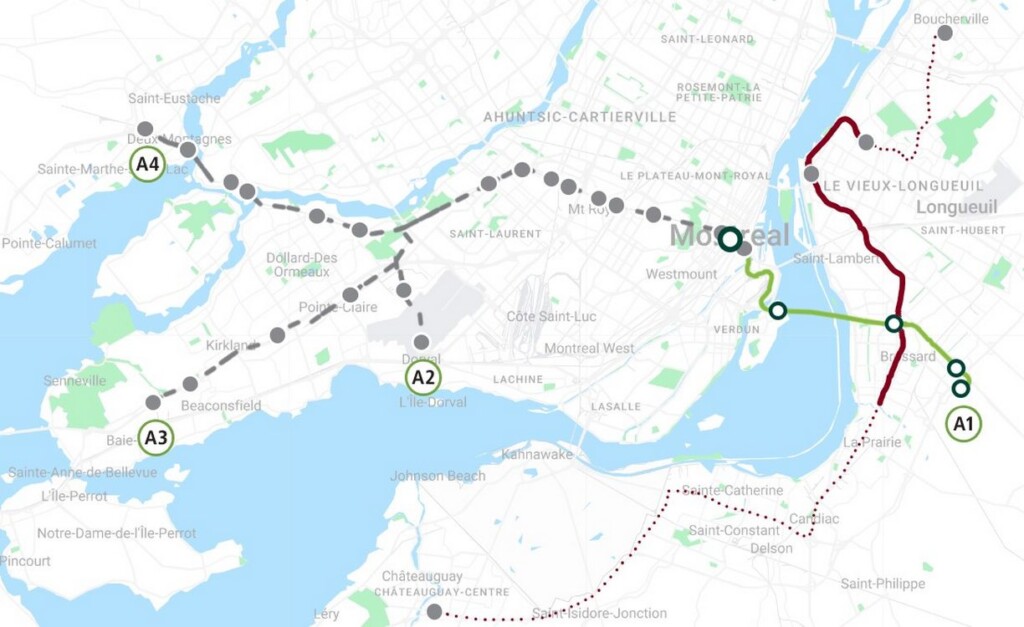

As of November 2025, it consists of 19 stations spanning 50 kilometers (31 mi), connecting Downtown Montreal with the suburb of Brossard and the northwestern Montreal suburbs. The West Island branch will open in the second quarter of 2026 and the branch to the Montréal–Trudeau International Airport will open in 2027.

Trains on the network are fully automated and driverless, and the stations are completely enclosed and climate controlled, built with light-colored, locally-sourced timber and glass.

Innovations from train systems around the world have been incorporated into the REM network design. Like in Japan, the train cars feature heated seats. Like in China, safety doors mounted on the platforms reduce injuries from not minding the gap. Like in Europe, the trains draw power from overhead wires.

However, the nature of Montreal’s climate has seen its designers adopt distinctly Quebecoise features, including gas-powered track heaters to prevent the switches from freezing solid, and reinforced arms meant to smash icy buildup along the overhead wires.

But more than the actual construction and design of the train, it was the planning and execution of its construction that make the REM really stand out among what Grescoe described as a sorry state of transportation among major Canadian cities.

Costing CAD$170 million per kilometer to build, REM is about 21.5-times cheaper than New York’s long-overdue Second Avenue Subway, 4-times cheaper than Toronto’s Eglinton Crosstown light rail, and around 6-times cheaper than light rail systems being built in San Francisco and Los Angeles. REM is 5-times cheaper than a mere 5-station long extension of Montreal’s existing Blue Line underground.

The contractor on the project is CDPQ Infra, the construction arm of the Caisse de dépôt et placement, (CDP) the manager of Quebec’s massive public pension fund. While this is hardly an example of the free market at work, what having CDPQ in charge did was introduce just enough free market economics to change the game in terms of cost savings; it was simply to reintroduce risk.

CDPQ and CDP were financing the project with what in effect is Quebec’s social security system; cost overruns and failure, therefore, would be taken out of people’s retirement accounts. That might seem diabolical, but if the state is financing the project with tax money, public choice economics demonstrates that this introduces moral hazard into the financing equation—too many people have too few incentives to keep costs down.

TRAINS TRAINS TRAINS: NYC Innovation Sees Century-Old Bridge Replaced – at $93M Under Budget, Without Stopping Trains

CDPQ began the cost savings by utilizing infrastructure such as bridges, existing rights of way, and highways to lay track along. This included the Champlain Bridge over the Saint Lawrence River, which was built some years ago with an empty central corridor for future transit options. It also built through the Mont-Royal Tunnel, and covered other corridors with elevated viaducts.

This lack of tunneling, bridge-building, and eminent domaining-away properties in the path of the railway line has meant that costs stayed down—to be expected, as it was in CDPQ’s interest from the start.

MORE QUEBEC NEWS: ‘We’re supposed to be good men’: Officer Buys Stranded Deaf Man Train Ticket to Get Home

CDPQ holds a 78% equity stake in the REM and will reap revenue from the service, paid out at the rate of 75 cents per kilometer per passenger, for 99 years. It was an investment by the pension plan for the future pensioners, and CDP expects to make 9% return-on-investment over the project’s life, which isn’t bad.

Most pensions funds around the world own some amount of US 30-year Treasury Bills, which at current rates garner 4.82%.

SHARE This Great News For Quebec Commutes With Your Friends…